does td ameritrade report to irs

If you have any questions please contact your Advisor or call TD. You may receive your form earlier.

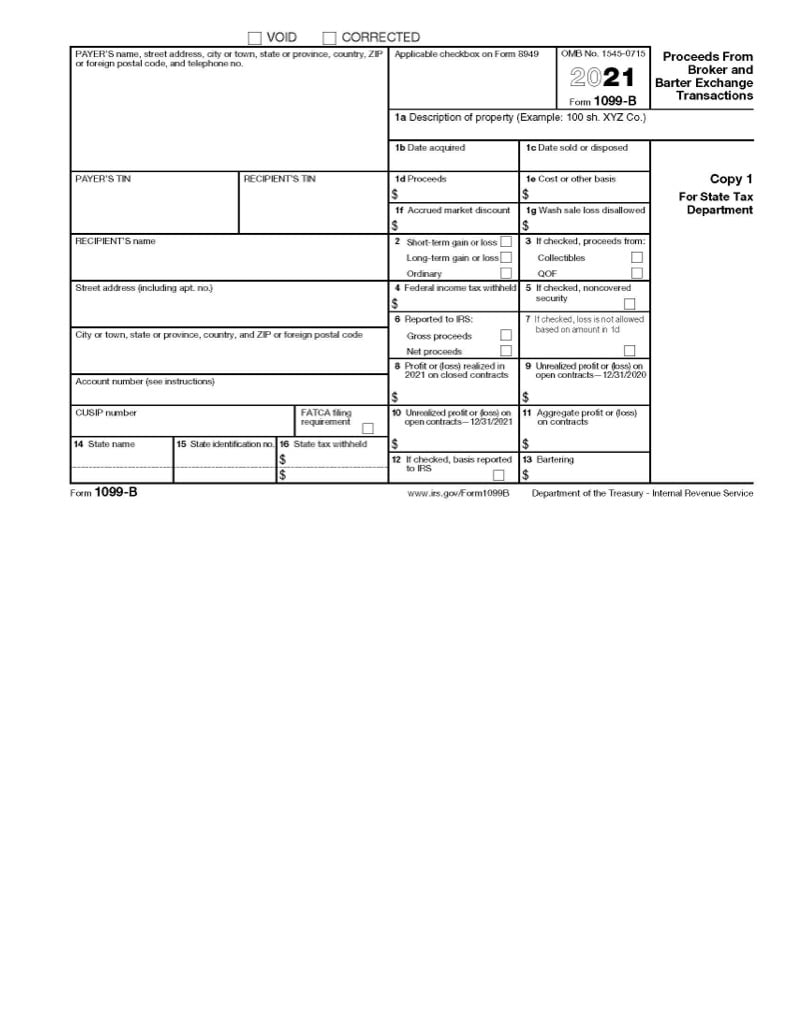

8949 Import Transactions Pdi Indicator Or Pdf Attachment 1099b 8949 Scheduled

TD Ameritrade does not report this income to the IRS.

. Its hard to figure the rule that TD. Under the Documents listing locate your T5. Posted on March 10 2017 by admin.

Required fields are marked Comment. Your email address will not be published. Open an Account Now.

The custodian bank is charged with safeguarding your financial assets to report required information to the IRS eg 1099s etc and provide you statements of your holdings. Ad No Hidden Fees or Minimum Trade Requirements. How far back can I get my tax.

Document ID Number What does TD Ameritrade report to IRS-----The most important part of our job is creating informational content. Steps to access your T5 through online banking. Intraday data is delayed at least 20 minutes.

What does TD Ameritrade report to IRS. Important tax dates We expect 1099s to be available online by February 15 2021 by the IRS deadline. Ad No Hidden Fees or Minimum Trade Requirements.

TD Ameritrade provides a downloadable tax exchange format file containing your realized gain and loss information. Download this file and submit it for processing by our program. Under the My Accounts list in the left hand column click View e-Documents.

According to the IRS pubs It is the earliest identical shares that will be adjusted not necessarily the recent ones that triggered a wash. Open an Account Now. TD Ameritrade will not report cost basis information on tax-exempt accounts to the IRS.

No you still have to report them. If you have any questions please contact your Advisor or call TD Ameritrade Institutional at 800-431-3500. The topic of this.

The detailed dividend statement you only need total qualified. There are two places where the 1099 B might show not reported to the IRS. 3 Supplemental Summary Page A snapshot of the additional information that TD.

Leave a Reply Cancel reply. TD Ameritrade does not report this income to the IRS.

Things To Remember Around Tax Time If You Ve Made A Qualified Charitable Distribution Merriman

Irs Form 1099 Div Reporting On Form 1040 Tax Return Youtube

Cryptocurrency Taxes Guide 2022 How Why To Report Your Profits

Form 1099 B Proceeds From Brokered And Bartered Transactions Jackson Hewitt

Irs Schedule D Form 8949 Guide For Active Traders

:max_bytes(150000):strip_icc()/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

Report Stock Sales On Taxes Easily How To Report Capital Gains Youtube

How Do I Report Stocks On Federal State Income Taxes

Need To Report Cryptocurrency On Your Taxes Here S How To Use Form 8949 To Do It Bankrate

How To Read Your Brokerage 1099 Tax Form Youtube

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

Irs Financial Report Available On Irs Gov Youtube

Need To Report Cryptocurrency On Your Taxes Here S How To Use Form 8949 To Do It Bankrate

Need To Report Cryptocurrency On Your Taxes Here S How To Use Form 8949 To Do It Bankrate

:max_bytes(150000):strip_icc()/irs-form-1099-b-639747198-a4a68c631a9e49d4a09a2ef325d31476.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition